Caring community members have given to grow our scholarship funds and make higher education possible for many students. For more information about establishing a scholarship, how to give to an existing scholarship, or to learn how to apply for a scholarship give us a call at (765) 793-0702.

The Wabash River Blueway Master Plan was conceived to develop recommendations for activating the Wabash River through Warren, Fountain, and Vermillion Counties. This plan studies the use of the Wabash River as a water trail through the use of existing and proposed river access sites and ties these assets to the towns within the corridor.

AFFILIATES - All

The application deadline is near for high school seniors from Fountain & Vermillion County to apply for the Lilly Endowment Community Scholarship, administered through the Western Indiana Community Foundation.

Students must apply by Monday, September 1 at: www.wicf-inc.org.

The scholarship will provide for full tuition, required fees, and a special allocation of up to $900 per year for required books and required equipment for four years of undergraduate study on a full-time basis, leading to a baccalaureate degree at any Indiana public or private college or university.

For answers to your questions, please contact the Community Foundation at (765) 793-0702, ext. 3.

AFFILIATES - All

Fountain and Vermillion County are home to many wonderful people who have made a deep impact in the community.

Are you looking for a way to memorialize a loved one or friend who is no longer with us? Or perhaps you would like to honor a family member, friend, co-worker, or service provider who has a positive influence in your daily life? MEMORIAL & HONOR GIFTS are great ways to honor those who are or have been significant in your life or the life of your community. Your gift will go to the fund you specify, in the name of the one you’re honoring.

The following individuals have recently passed away and the families have designated donations in their memory go to the Community Foundation. We honor the following individuals (click on the name for more details): Joe E. Beardsley, Gabriella “Gabby” Blankenship, Mary (Pugh) Winkler, Carolyn (Irwin) Feimster Helms, Esteleen Bowman McDonald, Tom Frey, John Fulton,Terry Badger, II, Doug Shelby, Melinda Shepherd, Alice Hathaway, Jill Kirkpatrick, Richard Rennick Sr, Irma Lee Crist, Vera Shew, Ethan Whyde, Mike Stump, Judy Ashton Ferrell, John Ives, Dr. Donna (Summers) McGrady, Louise Houmes, Gregory Spragg, Brenda Phillips, Carlotta Auter, Harold VanDame, Marvin Potter, Rose Martin, Kenneth Scheurich, Stan Shew, Bill Smail, Richard Pattengale, Jeff Henry, Page Lane, Barbara White, Tim Thomas, Harold R. Long, Cameron Cheuvront, Darleen Swingle, Duaine Ramey, Wanda Clawson, Terry Holland, Marvin Shaw, Dr. Francis McGrady, Jr., Matt Milach, Joe Henderson, Ginger Orr, Raymond Bush, Carl Dismore, Richard Klage, David Rothrock, Ann Johannes, Ronald Smith, Charles McKinney, Joe Hathaway, Edward C. Grubb, Sharon Sue Craft, Henry Meadows, Janice Vietti, Edward “Ed” George, and Carl Swinford.

All memorial and honor gifts are acknowledged to the person or people you designate so that the loved one’s family, or the person you are honoring, is aware of the gift. Or you can make an anonymous gift if you desire to do so. The amount of the gift is, of course, confidential and only you will receive a gift acknowledgement for tax purposes. It’s very easy to give a memorial or honor gift – just CLICK HERE to get started.

AFFILIATES - All

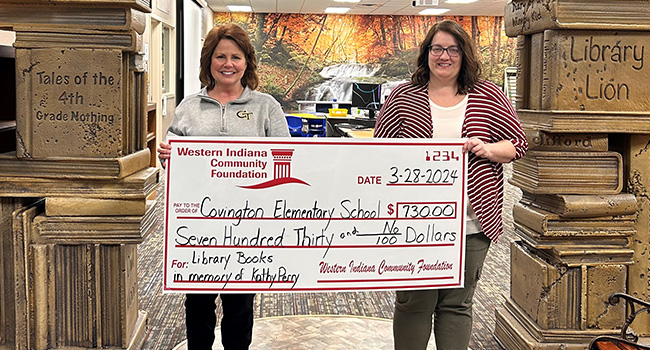

Congratulations to recent grant recipients:

Seeger Film Club ($2,000), Fountain County Horse and Pony ($18,500), Covington Park Program ($4,000), Covington Girls Softball League ($7,500), Veedersburg Park Program ($4,000), Attica Heritage Days ($5,000), Attica Pickleball Association ($37,500), Covington Youth Baseball League ($7,500), Food Finders ($6,000), Freedom Schoolhouse ($5,000), Attica-Williamsport Rotary ($2,500), Miss Fountain County Queen Pageant ($750), Clinton Little League ($2,500), North Vermillion School Corporation ($400), South Vermillion Middle School ($1,000), Union Hospital ($18,600), Attica Public Library ($1,150), Newtown Community Church ($2,000), Southeast Fountain School Corporation ($1,000), Vermillion County Reserves ($20,000), Community Action Program of Western Indiana ($3,400), Fountain County Old Guard VFW 2395 ($4,000), Hillsboro Christian Academy ($1,500), Attica Elementary School ($3,000), More →

AFFILIATES - All

Check out the Fountain County & Vermillion County Spring Newsletters at: WICF – Publications (wicf-inc.org)

AFFILIATES - All

The Western Indiana Community Foundation is honored to announce the establishment of the Gabriella “Gabby” Blankenship Scholarship Fund. This scholarship will primarily support students who plan to attend Purdue University, with preference given to those who demonstrate significant financial need and exemplify a well-rounded character, excelling academically, socially, and through involvement in their school or community. Full eligibility criteria and application details will be shared in the coming months.

Gabby passed away on May 7, 2025, at the age of 22. She was the beloved daughter of Bryan Blankenship and Misty Allen. A 2021 graduate of North Montgomery High School, Gabby was set to celebrate her graduation from Purdue University with a bachelor’s degree in hospitality on May 18, 2025. She had exciting plans to begin her career as the food and beverage manager at Mauna Lani – Auberge Resorts in Hawaii. Gabby’s vibrant personality and infectious laughter will be missed by everyone who knew her.

Contributions in memory of Gabby are tax deductible and can be made online at www.wicf-inc.org or mailed to: Western Indiana Community Foundation, ATTN: Gabriella “Gabby” Blankenship Scholarship Fund, PO Box 175, Covington, IN 47932.

AFFILIATES - All

The classmates of Attica High School’s Class of 1973 are working to establish a lasting fund to celebrate their class and ensure its legacy is remembered for generations. This fund also serves as a meaningful way to honor and memorialize classmates who are no longer with us, preserving their memory in a lasting way. Right now, donations to this fund are being matched $2: $1.

Every year, the Attica Community Foundation will use the earnings from this fund to award grants that benefit the Attica community.

Contributions can be made payable to the Attica Community Foundation and mailed to:

Attica Community Foundation

AHS Class of 1973 Fund

PO Box 161

Attica, IN 47918

Please include a note designating your donation for the Attica Class of 1973 Fund. Donations can also be made online here.

AFFILIATES - All

To better serve our community and ensure a fair and efficient review of grant requests, the Foundation is transitioning its 2025 grant application and review process to a structured three-tiered grant cycle process. This will involve new grant applications and review processes.

*It is important to note that each affiliate within WICF has its own funds for grantmaking.

The new grant cycles will be:

RAPID RESPONSE GRANTS (Grants less than $2,500)

Applications are reviewed monthly.

Applications Due: 15th of each month

Review Period: Month following application deadline

Notification of Award: Same month as review

IMPACT GRANTS (Grants $2,500-$7,500)

Applications are reviewed quarterly.

Applications Due: January 15, April 15, July 15, October 15

Review Period: February, May, August, November

Notification of Award: March, June, September, December

*We recommend a conversation with staff to discuss your project before submitting your application if applying for a grant between $2,501-$7,500.

LEGACY GRANTS (Grants $7,501+)

Applications are reviewed semi-annually.

Submit a letter of intent by: February 15, August 15

Applications Due: April 15, October 15

Review Period: May, November

Notification of Award: June, December

*Submit a letter of intent.

*A presentation to our board of directors and staff is required.

AFFILIATES - Attica - Covington - Southeast Fountain - Vermillion County

A variety of new endowment funds have recently been established to benefits area communities and high school students. For more details click on the link to learn more about each fund.

The new funds include: Attica Community Scholarship Fund, Mark, Susan, and Matthew Milach Unrestricted Fund, Duane & Phyllis Woodrow Scholarship Fund, Attica Student Meal Assistance Fund, Help-a-Teacher Fund, Parke-Vermillion Humane Society Fund, Fountain County Historic Preservation Fund, Austin & Martha Reed and Harold & Dorothy Short Unrestricted Fund, Richard A. & Sue A. Reed Unrestricted Fund, Steve and Karen Milligan Fund, Robert & Phyllis DeSutter Unrestricted Fund, Robin & Peg Montgomery Scholarship Fund, Jack & Marguerite Fenoglio Community Fund, The Galloway-Hoagland Farm Scholarship, The Nancy Moreman Strawser Nursing Scholarship, Larry & Merry Addison Family Community Impact Fund, James and Martha Foster Family Unrestricted Fund, Don and Jane Coonce Family Fund, Delores Kokotkiewicz Covington Park Fund, Fountain County Teacher Classroom Supply Assistance Program, Dallas Ponder Memorial Scholarship, Mark and Kathy Haas Unrestricted Fund, John & Pauline Bossaer Unrestricted Fund, Clinton Community Improvement Fund, E. Stanley & Vera Shew Unrestricted Fund, Lawrence & Patricia DeSutter Family Farm Memorial Scholarship, Dr. William Somerville Scholarship Fund, Robert & Helen Shelby Community Fund, Marilyn’s Village Inc., John & Madeline Ives Community Fund, Terry A. Badger III Scholarship Fund, Coal Creek Cemetery Endowment & Pass-Through Funds, and more!

To learn how you can establish a fund to benefit your community contact Dale at (765) 793-0702 or by email at dwhite@wicf-inc.org.

AFFILIATES - All

The Vermillion County Community Foundation is pleased to announce the recipient of the 2025 Lilly Endowment Community Scholarship for Vermillion County – Carolyn Hamblen of South Vermillion High School. She is the daughter of Courtney Hamblen and Donnie Hamblen. Lilly Endowment Community Scholars are known for their community involvement, academic achievement, character, and leadership.

“Carolyn intends to pursue a pharmacy career. She will graduate with a Core 40 with an Academic and Technical Honors diploma. She has a 3.97 GPA while taking AP and Honors courses,” said Nancy Reed, Lilly Endowment Community Scholarship Coordinator for the Vermillion County Community Foundation.

Several school activities with leadership roles are on Carolyn’s resume. She serves as Secretary of the National Honor Society, is a member of Academic Excellence, and has been captain of the Academic Super Bowl team for two years. As Co-Founder and President of the Art Club, Carolyn has demonstrated her initiative and leadership. She is also a three-year varsity tennis player and recipient of the Wildcat Award, a one-year member of the basketball team, and served as the IHSAA student-athlete leadership conference representative.

Miss Hamblen works at the Clinton McDonalds and works 20-30 hours weekly as a Crew Trainer. She enjoys the leadership role and communication with staff and the public.

Carolyn values community involvement, demonstrated by her volunteer work at the Clinton Public Library, where she finds great joy in working with children, inspired by her childhood memories. Carolyn has completed commissioned art projects and contributed to a community mural project. Her artwork is proudly displayed on the side of the Clinton Community Building as part of a mural created by the Art Club.

Carolyn’s personal essay is a clear explanation of why and how she chose her career and intends to attain it. Her connection to the community, both as a child and a young adult, has played a significant role in shaping her goals. Her passion for math and science inspired her to pursue a career in pharmacy, viewing it as an opportunity to give back and serve her community after graduation. She is committed to becoming a pharmacist and has clear long-term goals for her future.

The 2025 Lilly Scholar had a very bright personality, was poised, and had a professional appearance during her second interview for the selection process. Carolyn spoke openly about her aspirations for personal growth and maximizing her potential. She plans to earn a pharmacy technician license and work while attending college to defray the cost of attendance. Throughout her interviews, she demonstrated confidence, preparation, and a passion for her goals and commitment to community service. Carolyn’s enthusiasm was evident as she discussed her love for art, working with children, her plans to obtain a pharmacy technician license, and her long-term goal of earning a doctorate in pharmacy.

Appraisal letters from the school counselor, staff, and employer were enthusiastic to support Carolyn as a Lilly Scholarship applicant. They described her as a top scholar, driven, mature, responsible, respectful, having a great work ethic, creative, versatile, a great role model, and genuinely kind.

Each Lilly Endowment Community Scholarship provides for full tuition, required fees, and a special allocation of up to $900 per year for required books and required equipment for four years. The scholarship is for full-time undergraduate students leading to a baccalaureate degree at any eligible Indiana public or private nonprofit college or university. Lilly Endowment Community Scholars may also participate in the Lilly Scholars Network (LSN), which connects both current scholars and alumni with resources and opportunities to be active leaders on their campuses and in their communities. Both the scholarship program and LSN are supported by grants from Lilly Endowment to Independent Colleges of Indiana (ICI) and Indiana Humanities.

“I am very happy I get to pursue my education without financial worries. I am so honored,” said Carolyn, Lilly Endowment Community Scholarship recipient.

16 Vermillion County students applied for this year’s Lilly Scholarship. In determining Vermillion County’s Lilly Endowment Community Scholar nominees, consideration was given to criterion of academic performance, school activities and/or work, volunteerism, personal statement of need, letters of recommendation, goal essay, and interviews by the Vermillion County’s Nominating Committee. After the field of applicants was narrowed down, nominees were submitted to ICI, the statewide administrator of the Lilly Endowment Community Scholarship Program, which approves the final selection of scholarship recipients.

“The high caliber applicants from North Vermillion and South Vermillion high schools are very impressive every year. These students are mature, goal-oriented, highly involved in their schools and communities, and strongly recommended by their counselors, teachers, and peers. Interviews reveal their character, personality, and factors that have led students to their career goals. The Vermillion County Community Foundation Nominating Committee is committed to their serious and compassionate decision-making task and aware of the impact of their decisions,” says Nancy Reed, Lilly Endowment Community Scholarship Coordinator for the Vermillion County Community Foundation.

Lilly Endowment created the Lilly Endowment Community Scholarship Program for the 1997-98 school year. Since then, grant funding in excess of $490 million has supported more than 5,300 Indiana students who have received scholarships through the program.

The primary purposes of the Lilly Endowment Community Scholarship Program are: 1) to help raise the level of educational attainment in Indiana; 2) to increase awareness of the beneficial roles Indiana community foundations can play in their communities; and 3) to encourage and support the efforts of current and past Lilly Endowment Community Scholars to engage with each other and with Indiana business, governmental, educational, nonprofit and civic leaders to improve the quality of life in Indiana generally and in local communities throughout the state.

Western Indiana Community Foundation, established in 1990, is a nonprofit, tax-exempt philanthropic organization that was founded as Western Indiana’s partner, resource, and steward in philanthropy. The Foundation manages $43.5 million in charitable assets and administers over 350 charitable funds – each of which supports the unique charitable intent of the donor who established the fund. Annually, the Foundation awards nearly 1.2 million dollars in grants and scholarships to support Fountain County communities and is a National Standards-certified community foundation.

Lilly Endowment Inc. is an Indianapolis-based private foundation created in 1937 by J.K. Lilly Sr. and his sons Eli and J.K. Jr. through gifts of stock in their pharmaceutical business, Eli Lilly and Company. Although the gifts of stock remain a financial bedrock of the Endowment, it is a separate entity from the company, with a distinct governing board, staff, and location. In keeping with the founders’ wishes, the Endowment supports the causes of community development, education, and religion. Although the Endowment funds programs throughout the United States, especially in the field of religion, it maintains a special commitment to its founders’ hometown, Indianapolis, and home state, Indiana.

Since 1997, Independent Colleges of Indiana has administered the Lilly Endowment Community Scholarship Program statewide with funding provided by Lilly Endowment. Founded in 1948, ICI serves as the collective voice for the state’s 29 private, nonprofit colleges and universities. ICI institutions employ over 22,000 Hoosiers and generate a total local economic impact of over $5 billion annually. Students at ICI colleges have Indiana’s highest four-year, on-time graduation rates, and ICI institutions produce 30 percent of Indiana’s bachelor’s degrees while enrolling 20 percent of its undergraduates.

AFFILIATES - Attica - Covington - Southeast Fountain

(Attica, IN) – Adalyn Small has been named the recipient of the 2025 Lilly Endowment Community Scholarship in Fountain County. Lilly Endowment Community Scholars are known for their community involvement, academic achievement, character, and leadership. Adalyn is the 44th Fountain County recipient of the Lilly Endowment Community Scholarship.

Each Lilly Endowment Community Scholarship provides for full tuition, required fees, and a special allocation of up to $900 per year for required books and required equipment for four years of undergraduate study on a full-time basis leading to a baccalaureate degree at any eligible Indiana public or private nonprofit college or university. Lilly Endowment Community Scholars may also participate in the Lilly Scholars Network (LSN), which connects scholars with resources and opportunities to be active leaders on their campuses and in their communities. Both the scholarship program and LSN are supported by grants from Lilly Endowment to Independent Colleges of Indiana (ICI) and Indiana Humanities.

Miss Small, of Attica High School, has plans to attend a university majoring in Biology with a premed track. Her career goal is to be a radiologist. Adalyn ranks 1st in her graduating class with a 4.0 GPA. She is the daughter of Christopher and Desirae Small of Attica.

Adalyn has been involved in numerous clubs, organizations, and sporting activities as she pursued her high school education including Softball, National Honor Society, Student Council, Band, Academic Bowl Teams, and more. Adalyn is a Patient Care Technician at Franciscan Health and has volunteered her time with many different organizations throughout her high school career.

One of Miss Small’s references wrote, “Adalyn’s zest for life and ability to reach people on all levels is what sets her apart. Her outstanding personality and noble character are some of her biggest attributes; there isn’t anything she wouldn’t do for someone, and she is always thinking of others over herself. I have never met a more driven young lady, who accomplishes anything and everything set before her. Adalyn is a one-of-a-kind individual who has found a balance between family, school, and life; it truly is a feat to be admired.”

Twenty-three Fountain County students applied for this year’s Lilly Scholarship. The first phase of the selection process included the high school faculty of each school recommending up to six applicants from their school to be considered by the local scholarship committee representing the same school district.

The second phase included each scholarship committee reviewing the applications and interviewing each applicant. Two nominees from each school are selected based on consensus.

The third phase of the selection process included each of the two nominees from each school being interviewed by the scholarship committees representing the two other school districts. Each committee member independently scores each applicant in six categories including academic performance, school activities and work, volunteerism, financial need, letters of reference and a personal interview with each committee member.

Following the final scoring, finalists were forwarded to Independent Colleges of Indiana, Inc. (ICI) for final selection of the Western Indiana Community Foundation’s Lilly Endowment Community Scholarship recipient.

Lilly Endowment created the Lilly Endowment Community Scholarship Program for the 1997-1998 school year and has supported the program every year since with tuition grants totaling in excess of $490 million. More than 5,300 Indiana students have received the Lilly Endowment Community Scholarship since the program’s inception.

The primary purposes of the Lilly Endowment Community Scholarship Program are: 1) to help raise the level of educational attainment in Indiana; 2) to increase awareness of the beneficial roles Indiana community foundations can play in their communities; and 3) to encourage and support the efforts of current and past Lilly Endowment Community Scholars to engage with each other and with Indiana business, governmental, educational, nonprofit and civic leaders to improve the quality of life in Indiana generally and in local communities throughout the state.

Western Indiana Community Foundation, established in 1990, is a nonprofit, tax-exempt philanthropic organization that was founded as Western Indiana’s partner, resource, and steward in philanthropy. The Foundation manages $43.5 million in charitable assets and administers over 350 charitable funds – each of which supports the unique charitable intent of the donor who established the fund. Annually, the Foundation awards nearly 1.2 million dollars in grants and scholarships to support Fountain County communities and is a National Standards certified community foundation.

Lilly Endowment, Inc. is an Indianapolis-based private philanthropic foundation created in 1937 by J.K. Lilly Sr. and his sons Eli and J.K. Jr. through gifts of stock in their pharmaceutical business, Eli Lilly and Company. Although the gifts of stock remain a financial bedrock of the Endowment, it is a separate entity from the company, with a distinct governing board, staff and location. In keeping with the founders’ wishes, the Endowment supports the causes of community development, education and religion. The Endowment funds significant programs throughout the United States, especially in the field of religion. However, it maintains a special commitment to its founders’ hometown, Indianapolis, and home state, Indiana.

Since 1997, Independent Colleges of Indiana has administered the Lilly Endowment Community Scholarship Program statewide with funding provided by Lilly Endowment. Founded in 1948, ICI serves as the collective voice for the state’s 29 private, nonprofit colleges and universities. ICI institutions employ over 22,000 Hoosiers and generate a total local economic impact of over $5 billion annually. Students at ICI colleges have Indiana’s highest four-year, on-time graduation rates, and ICI institutions produce 30 percent of Indiana’s bachelor’s degrees while enrolling 20 percent of its undergraduates.

FOUNTAIN COUNTY AFFILIATES

FOUNTAIN COUNTY AFFILIATES VERMILLION COUNTY AFFILIATES

VERMILLION COUNTY AFFILIATES